what items are exempt from sales tax in tennessee

Aviation fuel actually used in the Charges. Groceries is subject to special sales tax rates under Tennessee law.

Tennessee Non Profit Sales Tax Exemption Certificate

For example gasoline textbooks school meals and a number of healthcare products are not subject to the sales tax.

. 12 - Tennessee Sales Tax Exemptions. Several examples of items that are considered to be exempt from Tennessee sales tax are medical supplies certain groceries and food items and items which are used in the process. Tennessee does not exempt any types of purchase from the state sales tax.

Tennessee does not exempt any types of purchase from the state sales tax. Tennessee does not exempt any types of purchase from the state sales tax. In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Tennessee Department of Revenue Taxes Sales Tax Holiday Follow STH-2 - Sales Tax Holiday - Qualifying Items During the holiday the following items are exempt from sales. Some exemptions are based on the product purchased. All individuals as well as businesses operating in the state must pay use tax when the sales tax was not collected by the seller on otherwise taxable products brought or shipped into.

Groceries is subject to special sales tax rates under Tennessee law. Tennessee does not exempt any types of purchase from the state sales tax. If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along with gift information and.

12 - Tennessee Sales Tax Exemptions. 12 - Tennessee Sales Tax Exemptions. Groceries is subject to special sales tax rates under Tennessee law.

Sales Use Tax Follow SUT-21 - Sales and Use Tax for Contractors - Overview Generally contractors and subcontractors are users and consumers and must pay tax on the. Several examples of of items that exempt from Tennessee. In most states necessities such as groceries.

If you sell any. Groceries is subject to special sales tax rates under Tennessee law. If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along with gift information and.

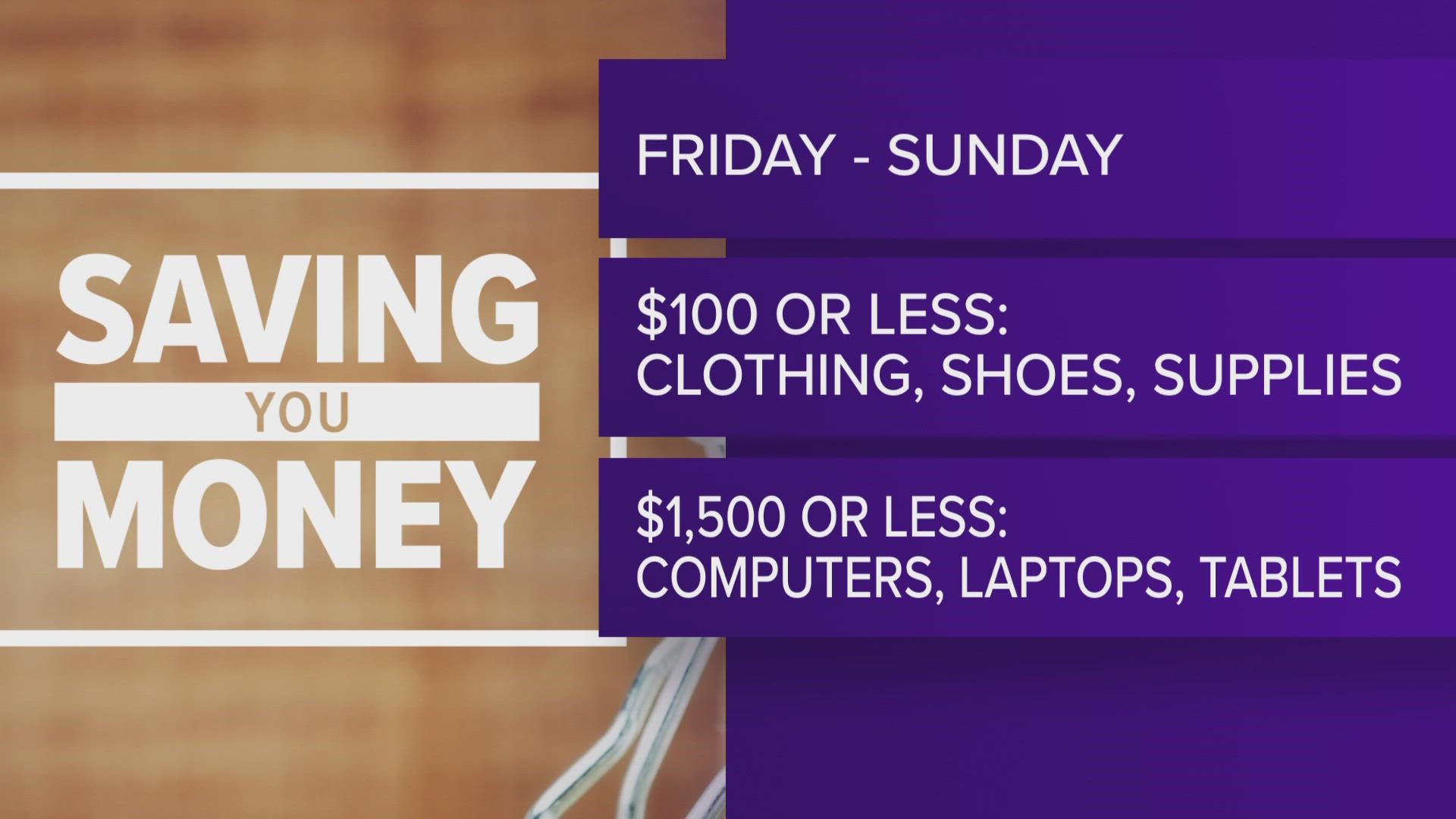

Sales tax-exempt items include clothing and footwear under 100 accessories and equipment under 50 school supplies and electronics.

Tax Free Weekend In Tennessee 10 Things Everyone Should Buy

Tennessee Sales Tax Guide For Businesses

Tennessee To Have Three Sales Tax Holidays In 2022 Ucbj Upper Cumberland Business Journal

Tennessee Sales Tax Holidays What You Need To Know Wbbj Tv

Sales Tax On Grocery Items Taxjar

State And Local Sales And Use Tax Returnsls450 Pay Online Tn Form

Tennessee Sales Tax Handbook 2022

Tennessee Sales Tax Small Business Guide Truic

How To Register For A Sales Tax Permit In Tennessee Taxvalet

Tennessee Bill Would Exempt Groceries From Sales Tax For May Through October 2021 Wbir Com

Form F1305401 Fillable Application For Exemption From Sales Tax For Interstate Telecommunications In The Operation Of A Call Center

Tennessee Sales Use Tax Guide Avalara

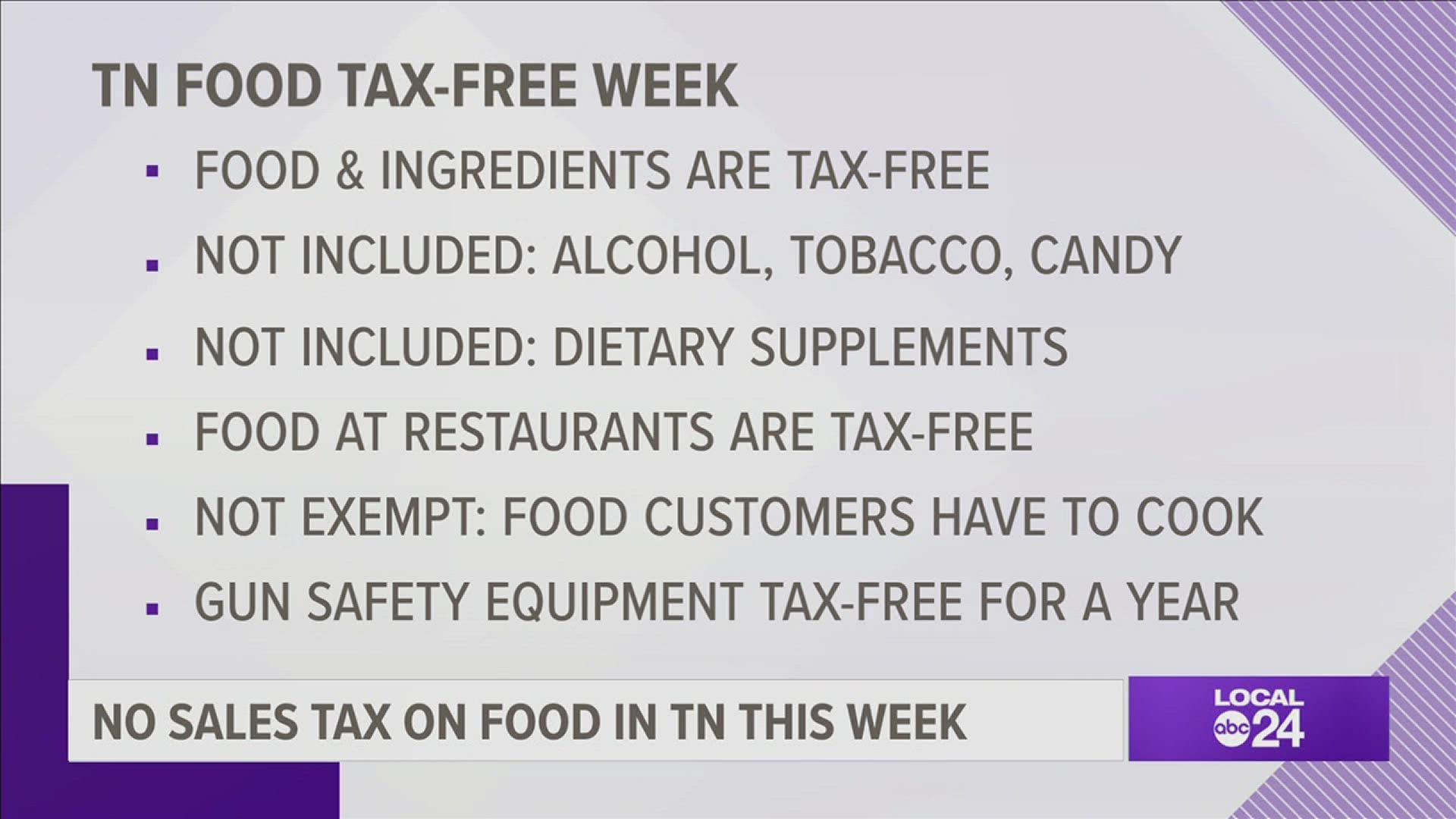

Tn Has Its First Ever Tax Free Week On Food Localmemphis Com

Ms Cheap Tennessee S Tax Holiday 2022 Offers Savings On Groceries For All Of August Ms Cheap Mainstreet Nashville Com

Time Again For Tennessee And Mississippi S Sales Tax Holiday Localmemphis Com

Jackson Tennessee Tennessee Tax Free Weekend

/cloudfront-us-east-1.images.arcpublishing.com/gray/J547QPKMGREI7CGRFJZAZNS66Y.png)

Tax Free Holiday Weekends Begin In Tennessee And Virginia Friday

Tennessee Agricultural Sales Or Use Tax Exemption Certificates Don T Exempt Everything Avalara